FREE CASH FLOW FORMULA EBIT HOW TO

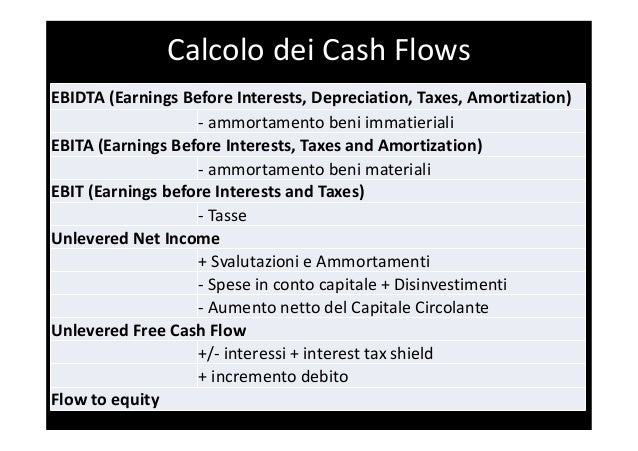

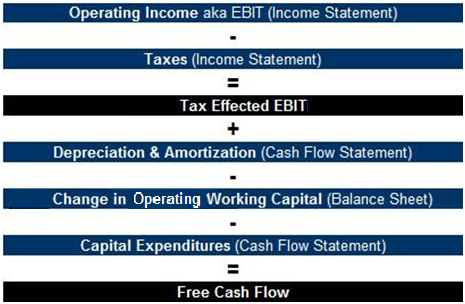

Here’s how to calculate free cash flow for Tim’s business using the FCF formula:Īs you can see, Tim’s free cash flow is greater than his capital expenditures. Tim’s financial statements listed the following numbers: We also have to adjust the profit for the change in working capital. In order to calculate the operating cash flow, we need to add back any non-cash expenses that reduced his net income like depreciation and amortization. Tim’s income statement shows that he had a net profit of $100,000 after taxes last year. The new investors want to analyze the store’s free cash flows to see if it would be worth their time. Thus, he wants to bring on new investors. Tim wants to expand into new territories, but he can’t do it on his own. Tim’s Tool Shop is a small home improvement store that sells tools and other household goods. If there is a deficit, the company will have to dip into savings or take out a loan to fund its activities. If there are excess funds, the company can give some to their investors. This measurement compares the money coming in the door to the money being paid out for operations and expenditures. We aren’t measuring the cumulative cash asset account. Keep in mind, that we are measuring cash flow. It basically just measures how much extra cash the business will have after it pays for all of its operations and fixed asset purchases. The OCF portion of the equation can be broken down and be calculated separately by subtracting the any taxes due and change in net working capital from EBITDA.Īs you can see, the free cash flow equation is pretty simple. The free cash flow formula is calculated by subtracting capital expenditures from operating cash flow.

Now that we know why this ratio is important, let’s answer the question what is FCF? Thus, investors look at this ratio to gauge how well the business is doing and more importantly will it be able to provide a return on their investment.Ĭreditors, on the other hand, also use this measurement to analyze the cash flows of the company and evaluate its ability to meet its debt obligations. It’s difficult to fake the cash flow coming in and leaving a company. That’s not really possible with this calculation. Other financial ratios can be adjusted or changed by management’s treatment of accounting principles. Investors like this measurement because it tells the truth about how a business is actually doing. Investors and creditors use this ratio to analyze a business in a number of different ways. This is an important concept because it shows how efficient the business is at generating cash and if it can pay its investors a return after it funds its operations and expansions. In other words, this is the excess money a business produces after it pays all of its operating expenses and CAPEX.

Free Cash Flow, often abbreviate FCF, is an efficiency and liquidity ratio that calculates the how much more cash a company generates than it uses to run and expand the business by subtracting the capital expenditures from the operating cash flow.

0 kommentar(er)

0 kommentar(er)